- 859-818-9922

- garyw@frontlinewealthcare.com

Menu

Clients expect to experience a high level of confidence, trust and clarity in relationships with professionals trained in the distinct process and discipline of financial planning. It is essential that they receive professional care, quality and excellence in the services they receive.

I provide financial planning for the yachtless, who don't speak finance as a first language, and want to work with someone that has already been to a few rodeos.

Helping clients reach their financial goals for over 30 years. You shouldn't be part of someone's learning curve.

Convenient and time-saving. Meet and review your financial strategies online from the comfort of your home. Great for busy families.

When you have a question, I'm available. It's important to both of us.

You no longer have to wait until you have "enough". The most important step is to get started.

Everyone has made a money mistake in the past. Time to focus on better strategies for the future.

No long-term contracts. No fear of big penalties or termination fees.

Everything is made from scratch. My strategies are custom created for you and your situation.

Services We Offer

Financial planning is about more than assets, investments and net worth.

A Financial Plan:

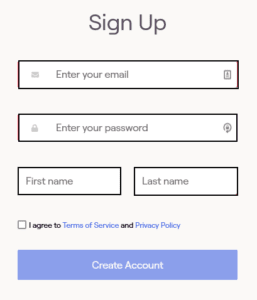

Tools to Help You Understand Your Current and Future Financial Picture

Stay On Top of Your Financial Life

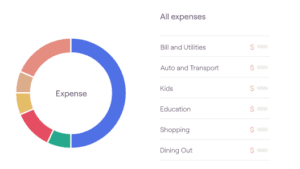

Combining all your financial data in one place is the starting point for higher quality financial decisions.

A single view enables holistic decision making. No more making piecemeal or siloed decisions.

Set up your account today to unlock opportunities and ensure you’re on the path to success.

On track for retirement? Buying a house? Saving for college?

Stay on top of your budget and track your expenses.

Link your financial accounts with automatic daily updates.

Retirement, college planning, Social Security optimization, tax planning, and more.

It's an Important Question

Everyone’s financial picture is different. I don’t try to make one solution work for everyone. Hire a professional on terms that fit your needs.

Ways we can work together:

Introductory plan for healthcare workers.

Initial Plan. Three month financial planning engagement. Approximately 6 hours of meeting time.

Update - if needed - years 2 and later.

Analysis done for a single financial issue

Planning & Investment Package

Annual Fee (% of Assets Under Management)

401(k) Account Management

I began as a financial professional in 1988 and have developed a process to assist Healthcare Professionals and others with the decisions necessary to improve and maintain their financial health.

I believe a financial or retirement plan is an ongoing process, not a single event, and that creating a plan should be a joint, collaborative effort. Clients find this approach educational and empowering, not intimidating or judgmental.

This is especially important for those that have not used the services of an advisor before, have had a bad experience, or feel they are “too small” for an advisor’s attention.

Get updates with our latest insights. We never spam!

© 2024 Gary L Williams. All Rights Reserved.

United Advisors Group, d/b/a Frontline Wealthcare, is a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

United Advisors Group Form ADV Part 2A & CRS can be obtained by visiting:

https://adviserinfo.sec.gov and search for our firm name. Neither the information nor any opinion expressed is to be construed as solicitation to buy or sell a security of

personalized investment, tax, or legal advice.

Provide your information and I’ll get back to you quickly.

Get this valuable resource – a comprehensive checklist of the financial issues that you need to consider when dealing with high inflation.

Get this valuable resource – a comprehensive checklist of the financial issues that you need to consider surrounding a job loss.